Fascination About Independent Financial Advisor copyright

Fascination About Independent Financial Advisor copyright

Blog Article

All about Retirement Planning copyright

Table of ContentsIndependent Investment Advisor copyright Fundamentals ExplainedOur Investment Representative DiariesThe Single Strategy To Use For Independent Investment Advisor copyrightThe smart Trick of Lighthouse Wealth Management That Nobody is DiscussingIndicators on Investment Consultant You Need To KnowNot known Details About Lighthouse Wealth Management

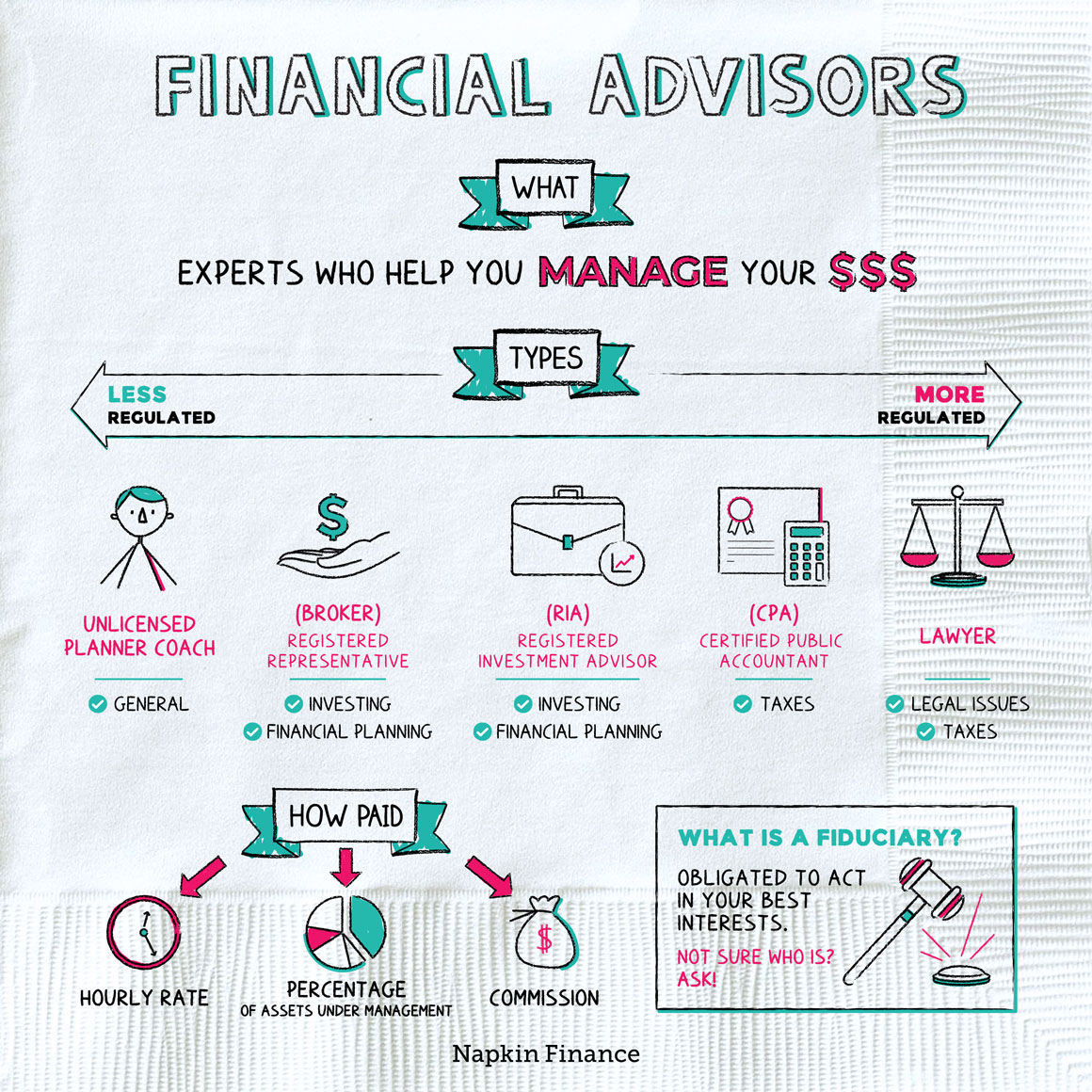

“If you're purchasing a product, say a tv or some type of computer, might want to know the requirements of itwhat tend to be the components and exactly what it can do,” Purda explains. “You can remember buying financial information and assistance in the same manner. People must know what they are getting.” With economic information, it's vital that you understand that the item isn’t bonds, shares or any other financial investments.it is things such as cost management, planning pension or paying off financial obligation. And like purchasing some type of computer from a trusted organization, customers need to know they might be getting monetary advice from a reliable professional. Certainly Purda and Ashworth’s most fascinating results is about the charges that monetary planners cost their customers.

This presented true regardless of the fee structurehourly, commission, assets under management or flat rate (when you look at the learn, the dollar property value charges ended up being the exact same in each instance). “It still boils down to the value proposal and anxiety in the buyers’ component they don’t understand what they truly are getting into change for those costs,” says Purda.

Independent Financial Advisor copyright Fundamentals Explained

Tune in to this article once you listen to the term economic specialist, exactly what pops into the mind? Lots of people consider a professional who is going to give them economic guidance, particularly when considering investing. That’s an excellent starting point, however it doesn’t color the full picture. Not even near! Financial analysts enables people who have a number of additional money targets as well.

A financial expert makes it possible to build wealth and protect it for the overall. Capable calculate your own future economic requirements and program methods to stretch your retirement cost savings. They're able to also give you advice on when you should begin making use of personal protection and using the funds inside pension reports so you can stay away from any awful penalties.

The Best Strategy To Use For Ia Wealth Management

They may be able allow you to figure out what common resources are best for your needs and show you how-to handle making many of opportunities. Capable in addition help you comprehend the threats and exactly what you’ll need to do to obtain your goals. A seasoned investment professional will help you remain on the roller coaster of investingeven whenever your assets get a dive.

They are able to supply you with the guidance you need to develop a strategy so you can ensure your desires are carried out. Therefore can’t put a cost label from the comfort that is included with that. Based on research conducted recently, the average 65-year-old couple in 2022 needs to have around $315,000 stored to pay for health care costs in pension.

The 9-Minute Rule for Independent Investment Advisor copyright

Given that we’ve gone over just what financial analysts do, let’s dig in to the a variety. Here’s a great principle: All monetary planners are financial advisors, not all analysts tend to be coordinators - https://lwccareers.lindsey.edu/profiles/4232859-carlos-pryce. A financial coordinator concentrates on assisting men and women make intends to achieve lasting goalsthings like starting a college fund or conserving for a down repayment on a home

.jpg)

How do you know which economic expert suits you - https://sketchfab.com/lighthousewm? Below are a few things you can do to be certain you are really hiring the proper see this website person. What do you do once you have two bad options to select from? Simple! Discover a lot more solutions. More choices you really have, the more likely you will be to help make an effective decision

Everything about Independent Investment Advisor copyright

Our wise, Vestor system makes it possible for you by showing you doing five economic analysts who are able to serve you. The good thing is actually, it is completely free to obtain associated with an advisor! And don’t forget to come to the interview prepared with a list of questions to ask in order to determine if they’re a good fit.

But listen, because an expert is actually wiser compared to the average bear doesn’t provide them with the right to inform you what you should do. Occasionally, analysts are loaded with by themselves simply because they do have more levels than a thermometer. If an advisor starts talking down to you, it's time for you to show them the door.

Just remember that ,! It’s important that you and your financial advisor (whoever it ends up getting) take equivalent page. You need an advisor who's got a lasting investing strategysomeone who’ll encourage you to definitely keep investing regularly whether or not the market is upwards or down. tax planning copyright. In addition, you don’t want to deal with an individual who forces one purchase something that’s as well risky or you are not comfortable with

The Best Strategy To Use For Independent Financial Advisor copyright

That combine gives you the variation you ought to successfully invest when it comes down to longterm. As you research monetary experts, you’ll probably run into the phrase fiduciary obligation. All of this indicates is any expert you hire has to work in a fashion that benefits their own customer and never their very own self-interest.

Report this page